The technique has proven to be very useful for finding positive surprises. Shares of beauty salon owner and operator Regis Corp. soared 9.3% toward a 7-week high in morning trading Monday, as , after having closed them a https://1investing.in/ result of the COVID-19 pandemic. Regis Corp., the parent of Supercuts, Cost Cutters and other salons, recorded a wider loss and lower revenue for the September quarter due to Covid-19 store closures and lower traffic.

Regis Corporation owns and franchises hair care salons in North America. The company operates through two segments, Franchise Salons and Company-Owned Salons. Its salons provide haircutting; styling, including shampooing and conditioning; hair coloring; and other services, as well as sells various hair care and other beauty products. The company also operates accredited cosmetology schools. It operates its salons primarily under the SmartStyle, Supercuts, Cost Cutters, Roosters, First Choice Haircutters, and Magicuts concepts names.

NYSE: RGS

Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements. Regis Corp. said late Wednesday it is planning strategic alternatives for its mall-based hair salons. The operator of the Regis Salons and MasterCuts hair salon chains said it has retained the firm Huron Transaction Advis… According to one analyst, the rating for RGS stock is “Strong Buy” and the 12-month stock price forecast is $2.0.

- Regis also operates a smaller portfolio of premium salons across North America and the U.K.

- RGS’s beta can be found in Trading Information at the top of this page.

- Shares of beauty salon owner and operator Regis Corp. soared 9.3% toward a 7-week high in morning trading Monday, as , after having closed them a result of the COVID-19 pandemic.

- Since then, RGS shares have decreased by 27.9% and is now trading at $0.88.

- Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

The company is scheduled to release its next quarterly earnings announcement on Tuesday, November 7th 2023. Regis’ stock was trading at $1.22 on January 1st, 2023. Since then, RGS shares have decreased by 27.9% and is now trading at $0.88. Style is an investment factor that has a meaningful impact on investment risk and returns.

Why KnowBe4 Shares Jumped Over 28%; Here Are 79 Biggest Movers From Yesterday

Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of RGS stock can currently be purchased for approximately $0.88. Click the link below and we’ll send you MarketBeat’s list of seven stocks and why their long-term outlooks are very promising. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time. This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply. Compare

RGS’s historical performance

against its industry peers and the overall market.

Regis Corporation was founded in 1922 and is headquartered in Minneapolis, Minnesota. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.32% per year.

Consumer Discretionary Stocks Moving In Tuesday’s Intraday Session

© 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer.

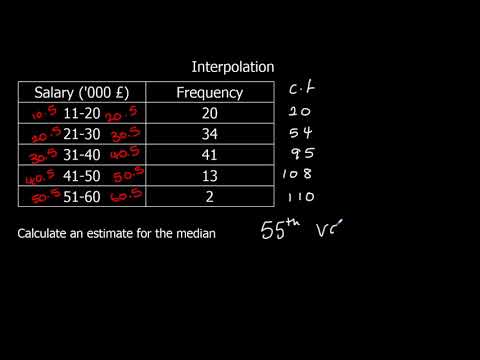

Style is calculated by combining value and growth scores, which are first individually calculated. Get this delivered to your inbox, and more info about our products and services. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

Analyst Ratings Regis Corp.

Our Quantitative Research team models direct competitors or comparable companies

from a bottom-up perspective to find companies describing their business in a

similar fashion.

La Opala RG’s (NSE:LAOPALA) Dividend Will Be Increased To ₹3.00 – Simply Wall St

La Opala RG’s (NSE:LAOPALA) Dividend Will Be Increased To ₹3.00.

Posted: Thu, 14 Sep 2023 00:31:01 GMT [source]

5 employees have rated Regis Chief Executive Officer Felipe Athayde on Glassdoor.com. Felipe Athayde has an approval rating of 53% among the company’s employees. This puts Felipe Athayde in the bottom 25% of approval ratings compared to other CEOs of publicly-traded companies.

Regis Corp owns, franchises, and operates beauty salons throughout North America and the United Kingdom. The company’s locations provide salon products and services to the mass market, including haircutting, styling, and hair coloring. The vast majority of Regis’ salons are in strip malls, shopping centers, and Wal-Mart stores in North America and serve price-conscious customers. The company derives the majority of its revenue from these locations.

The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. Stocks ended the day down, failing to rebound from their worst week since mid-2013. But several individual stocks fared far worse than the broader market, as Geron plunged 15%, Regis fell 10%, and Nam Tai Electronics dropped 12%. The haircut specialist reported earnings, and investors were not pleased.

It operates through the Company-Owned Salons and Franchise Salons segments. The segments offer haircutting, styling, hair coloring, and other related services. Its brands include Supercuts, SmartStyle Hair Salon, Cost Cutters, First Choice Haircutters, Roosters, Opensalon, and Best Cuts. The company was founded by Paul Kunin and Florence Kunin in 1922 and is headquartered in Minneapolis, MN.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

The sale of products also contributes a relatively significant percentage of total sales. Regis also operates a smaller portfolio of premium salons across North America and investment banking meaning the U.K. The company’s majority brands include SmartStyle, Cost Cutters, and Supercuts. Regis Corp. engages in the ownership, franchise, and operation of beauty salons.